Financial Aid and Paying For College

The Student Financial Aid Office is here to help you through the financial aid process and answer all your questions. FAFSA is a separate process from admission to BMCC. A student must have an application on file through admissions in order to process an application for financial aid. Please fill out an admissions application here. If you don’t find the information you need on the following pages, please contact our office at 906 248-3354 or via e-mail at [email protected].

Bay Mills Community College offers a variety of federal, state, and local scholarships, grants and work-study opportunities. Many students are eligible for financial aid and should apply to find out what financial aid may be available.

Most financial aid is based on need and is intended to assist students whose families cannot pay all, or perhaps any, of the college costs. The difference between what it costs to attend BMCC and what a student and his/her parents can reasonably contribute is considered the student’s unmet need.

Types of Financial Assistance

BMCC offers three types of financial aid:

- Scholarships: Non-repayable money, usually based on academic performance and/or demonstrated financial need.

- Grants: Non-repayable money, usually based upon demonstrated financial need.

- College Work-Study: Part-time work during the school year and evidence of financial need is usually a requirement.

These types of assistance are often combined to form a financial aid “package”. The “package” is designed to make up any difference between the school expenses and the expected family contribution. In the packaging process, each eligible student may receive scholarship and/or grant aid, as well as work-study funds.

Apply for FAFSA

To apply for federal and state financial aid, you will need to complete the Free Application for Federal Student Aid (FAFSA). The school code for Bay Mills Community College is 030666.

You should start by applying for a FSA ID (a username and password) through the U.S. Department of Education. It is important to understand the student and parent may not share an FSA ID. Your FSA ID is your electronic signature, so it must be unique to you. If you are a parent of a dependent student, you will need your own FSA ID to sign your child's FAFSA form electronically. If you are the parent of more than one child attending college, you may use the same FSA ID to sign all applications, but each child must have his or her own ID.

Next, you will need to gather the documents needed to complete your FAFSA. Typically, these documents include your social security number or alien registration number, your federal income tax returns (Note: You may be able to transfer your federal tax return information using the IRS Data Retrieval Tool), W-2s and other records of money earned, bank statements and records of investments (if applicable), records of untaxed income (if applicable), and an FSA ID to sign electronically. If you are a dependent student, you will also need most of the above information for your parent(s).

Once you have gathered the documents, you can complete the FAFSA. There are helpful hints available on the FAFSA website which explains each of the fields you will need to complete. You may also contact our Financial Aid Office with any questions you may have.

When to Apply - Financial Aid Deadline

Don’t delay when applying for aid. Completing the free application for Federal Student Aid early will help you avoid missing deadlines, thereby maximizing the amount of aid for which you are eligible. The FAFSA can be filed as soon as October 1 of the student’s senior year of high school and each subsequent year in college. Bay Mills Community College highly recommends completing your application as soon as possible so students meet the State of Michigan’s March 1 state aid deadline. Completing your FAFSA early will ensure you have a complete financial aid file by the June 30 deadline. This deadline is for new and returning students. If you have other sources of financial aid, such as a direct pay by your tribe or employer, please submit a copy of the documentation to the Financial Aid Office by August 1 of each year.

If you do not have a complete financial aid file prior to the start of the semester, you may still apply for financial aid during the semester you are enrolled; however, you will be required to pay for your books at the time of purchase. You will also be required to pay in full or set up a payment plan with the Student Billing Coordinator for the cost of tuition and fees within five business days upon the start of the semester. If you are eligible for financial aid, refund checks will be issued during the semester for any excess financial aid.

Financial Aid Eligibility

The Federal Government has determined that financial aid will be made available only to those students who have received a high school diploma or earned a GED.

In order to be eligible for financial aid, a student must:

- Be a U.S. citizen or "eligible non-citizen"

- Be accepted for admission to BMCC

- Complete the FAFSA and submit all required documentation for the financial aid file

- Be enrolled for the minimum number of credit hours needed to fulfill program requirements

- Maintain satisfactory academic progress

- Register with Selective Service, if required by law

- Not be in default on any Title IV loan or Title IV grant received at any institution

- Complete the Anti-Drug Abuse Certification Statement

Federal Pell Grant Program

The Federal Pell Grant Program is a student aid program designed to provide undergraduate students with a base of financial aid to help meet the costs of attending college. The Federal Pell Grant is also the foundation from which all other student financial aid (federal, state, institutional, and private) is built. Eligibility for Pell is determined from the FAFSA application.

Federal Pell Grant Lifetime Eligibility

Students are limited to 12 semesters (six years) of Pell grant eligibility during their lifetime. This regulation affects all students regardless of when or where they received their first Pell grant. For example, if you received a full time Pell grant for 6 semesters (three years) at BMCC, you would be limited to 6 semesters (three years) at another college or university.

The U.S. Department of Education is tracking your lifetime eligibility percentage. Since the maximum amount of Pell grant funding a student can receive each year is equal to 100%, the six year equivalent is 600%. For example, if you received a full time Pell grant for two semesters, you used 100% for that year. In the next year, if you enroll at three-quarter time for two semesters, you used 75% for that year. Together, you would have used 175% out of the total 600% lifetime limit. You can determine how much Pell you have used and what you have remaining by logging into https://www.studentaid.ed.gov or by contacting BMCC’s Financial Aid Office.

You must plan now for your future, especially if you intend to transfer to a four year college and pursue a Bachelor’s degree. Complete your classes and stay on track with your academic plan to attain your Associate and Bachelor’s degrees within the six year lifetime limit!

Financial Aid Disbursement Dates - Refund Checks

If you qualify for financial aid, we will apply the financial aid to your college bill first and if your financial aid is greater than your bill, you are eligible for a refund. Financial aid refunds from the Pell grant are disbursed in three payments over the course of the semester. If you receive other types of financial aid, it will be disbursed on the closest refund date. Please refer to the Financial Aid Disbursement Date Schedule.

Forms & Links

Financial Aid Forms

Dependency Override Worksheet 25-26

Financia Aid Helpful Links

Federal Student Aid - Prepare for College

Federal Student Aid - Free Application for Federal Student Aid

Federal Student Aid - Create a New Federal Student Aid ID

Michigan.gov - Student Financial Services Bureau

Michigan Student Scholarships and Grants at a Glance

US Department of Veterans Affairs - Education and Training

American Indian College Fund Website

Jump Start Coalition - Personal Financial Literacy

360 Financial Literacy - Personal Financial Plans

Education Finance Council - Helping Families Plan and Pay for College

American Indian College Fund - Student Resources

Internal Revenue Service - Tax Transcript Request

Nursing Scholarships for Indigenous American Students

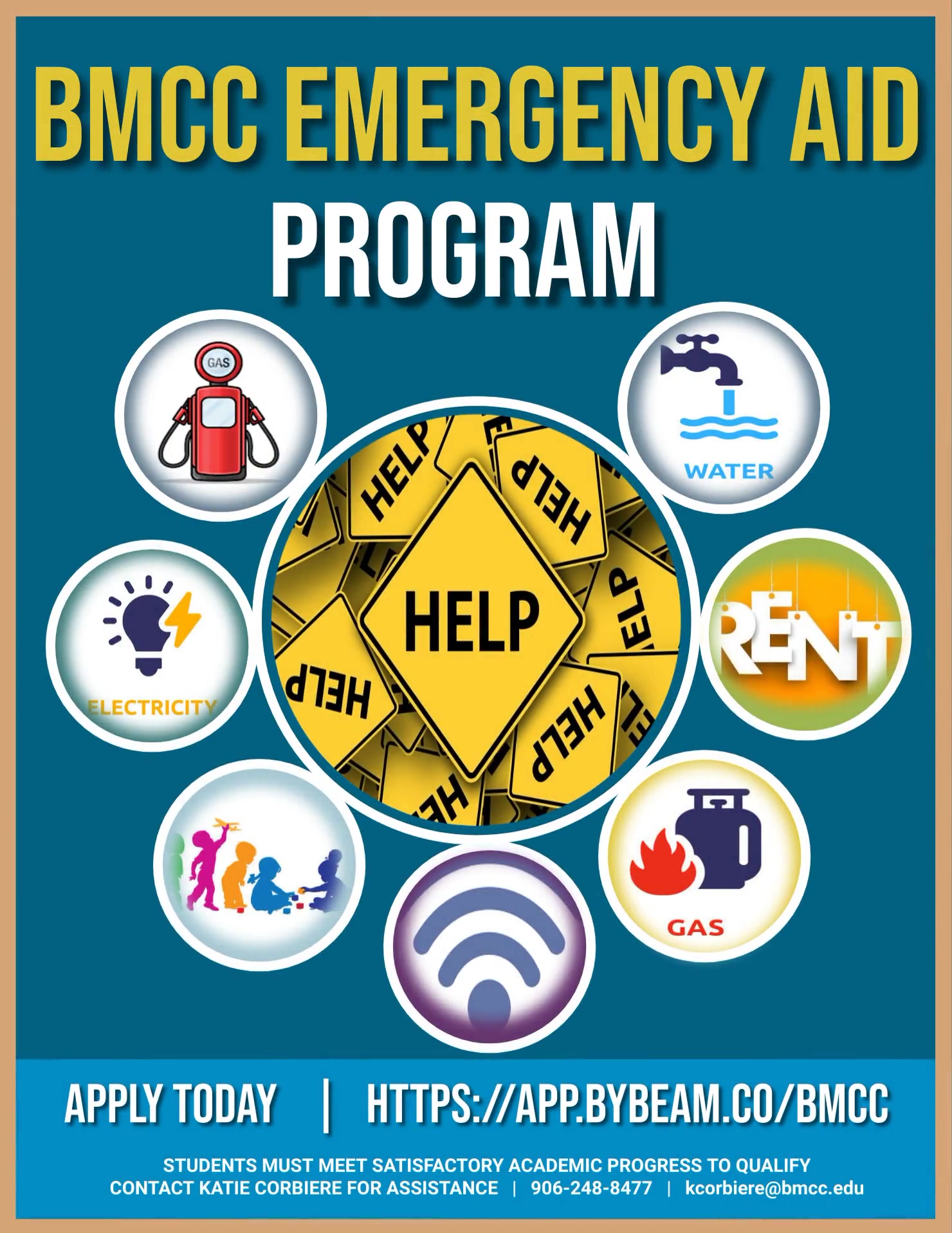

Emergency Aid Program

BMCC's Emergency Aid Program can help students if they're experiencing a wide variety

of challenges or difficulties. Students can apply at https://app.bybeam.co/bmcc

Contact Katie Corbiere for assistance at (906) 248-8477 or [email protected]

Pell Grant Attendance Requirement

BMCC is required to check attendance regularly as part of the Pell grant requirements. If you do not attend your classes, your Pell grant will be adjusted and you will receive a smaller financial aid refund check or you may have to pay back a portion of your Pell grant.

Return of Financial Aid for College Withdrawal or All F's

When you receive a Pell grant or Federal Supplemental Opportunity grant to attend Bay Mills Community College, you are agreeing to complete courses covered by your financial aid. According to Department of Education regulations, if you withdraw or stop attending all classes prior to completing more than 60% of a semester, your aid will be recalculated based on the percent of the semester you have completed. For example, if you received a $1,000 award and only completed 30% of the semester, you would need to pay back $700.

If you received F’s in all of your classes, the U.S. Department of Education requires a recalculation of your financial aid based on the last date you attended. For example, if you stopped attending classes after receiving your financial aid refund check and get all F’s, you may have to pay back a substantial amount because you didn’t earn your Pell award.

If you are thinking about withdrawing from all of your classes or decide to stop attending classes, please contact the Financial Aid Office to determine how this will affect your financial aid and possible repayment.

Satisfactory Academic Progress Policy

Federal law requires all students who receive federal financial aid to make Satisfactory Academic Progress (SAP) toward their degree. The intent of this policy is to ensure that students who are receiving federal financial aid are making measurable academic progress toward completion of an eligible academic program in a reasonable period of time. This will be evaluated at the end of each semester. At that time, the Financial Aid Office will review the student’s transcript to determine if the student is in compliance with the following requirements:

- Credit Hours

Students must earn at least 67 percent of the credit hours, which they attempt at BMCC on a cumulative basis. Students who fail to meet this requirement will be put on a SAP warning for their next semester of attendance. Students put on warning will be notified in writing of their status and informed of the deficiency requiring correction. Eligibility for financial aid will be suspended if the deficiency is not corrected by the end of the next semester of attendance.

- Grade Point Average (GPA)

Undergraduate students with a cumulative BMCC GPA below 2.0 will be placed on academic warning. Students put on SAP warning will be notified in writing of their status and informed of the deficiency requiring correction to be removed from SAP warning. Students on SAP warning are eligible for financial aid; however, those student(s) on SAP warning who fail to raise their GPA to the minimum 2.0 level after the semester of SAP warning will be placed on financial aid suspension. Students on SAP suspension are not eligible for federally sponsored financial aid programs. Transfer credits will not be considered in the cumulative BMCC GPA calculation.

Please contact the Financial Aid Office to obtain a copy of the entire Satisfactory Academic Progress policy.

Maximum Credit Hours

Students are limited to receiving federal financial aid for up to 150 percent of the number of credits required for their program of study. For example, if your associate degree requires 66 credits, you can obtain financial aid for up to 99 credit hours (66 x 150%) provided that you maintain satisfactory academic progress.

Right to Appeal Financial Aid Suspension

If your unsatisfactory progress was due to extenuating circumstances, you must appeal your Financial Aid Suspension within ten business days of the date on the notification letter. You must submit your appeal in writing to the Director of Financial Aid stating the reason for your unsatisfactory progress and in what way the situation has now been rectified, while attaching any appropriate documentation to your letter.

Omnibus Drug Initiative Act

All students receiving federal financial aid are required to certify that they will not engage in the unlawful manufacture, distribution, dispensing, possession, or use of a controlled substance while a student at BMCC. This act gives courts the authority to suspend eligibility for federal student financial aid when sentencing a student who has been convicted of a drug-related offense.